alabama delinquent property tax laws

Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home. State laws allow the local government to sell homes as part of a tax sale process to collect delinquent taxes from home sales are legalized in all states.

Property Tax Alabama Department Of Revenue

This code consists of two units 40-1-3.

. Under the Act those manufactured homes located on the owners property and not held for rent or lease will be assessed on the real property tax rolls in the Revenue Commissioners Office. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. In order and avoid costly penalties and often property owners must time their 2019 property tax or by January 31 2020 These tax statements.

You again will be forced to pay your Alabama property taxes if your debt is not paid. 40-10-21 and 40-10-132 Alabama Department of Revenue Property Tax Division 50 North Ripley Montgomery AL 36132 334 242-1170 Visit Alabama Department of Revenue Website. If the property has been tax delinquent for less than three years the state will assign the propertys tax sale certificate to you.

Section 40-10-143 Lien of persons other than holders of legal title for expenses of redemption. Code 40-1-3 apply to this case. Taxes in Alabama are due on October 1 but when theyre delinquent they become due on January 31.

Once there is a tax lien on your home the taxing authority may hold a tax lien sale. To encourage delinquent owners to pay their past-due property taxes the state of Alabama charges up to 12 per annum on the amount paid to satisfy the delinquent taxes which is passed directly to the tax lien certificate purchaser. CODE 40-10-180 THROUGH 40-10-200The second mechanism for Alabama counties to collect delinquent taxes was more firmly established by the Alabama legislatures enactment of HB354 in 2018.

In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Article 6 Refund of Taxes Paid by Mistake or Error. According to Alabama law you must file your taxes on October 1 and your taxes become delinquent on January 1.

Code 40-10-120. Section 40-10-142 Lien and sale of property for unpaid installments of taxes - Disposition of money. If you feel justifies a delinquent tax amount deemed.

Tax Delinquent Properties for Sale Search. 40-10-122 on the minimum and the overbid see notes on bidding. Our vision is to assure the citizens of Alabama that compliance with the property tax laws rules and regulations is maintained in an efficient and effective manner.

All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. Is Alabama A Tax Deed Or Tax Lien State.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. Below is a listing by county of tax delinquent properties currently in State inventory.

The transcripts are updated weekly. View How to Read County Transcript Instructions. In 2019 beginning with tax year 2018 delinquent properties Baldwin County Revenue Commission decided to migrate to the sale of tax liens.

Two recent articles describe how Alabamas property tax sale laws create disincentives for the purchase of tax-delinquent properties8 Both articles note that Alabama law strongly favors the interest of the owner of property sold for taxes9 One of the authors stated. In Alabama taxes are due on October 1 and become delinquent on January 1. If you owe no property taxes in Alabama your house may be sold if you owe an amount.

You can therefore refuse to pay any of the current local property taxes on your Alabama home so the county treasurer can sell a tax lien certificate to anyone willing to pay. If another party buys the lien you may redeem the property at any time within three years from the date of the sale. Tax lien certificates not sold at the county level can be purchased from the Alabama State Commissioner of Revenue Sec.

When taxes are due on October 1 and become delinquent on January 1 in Alabama then the taxable amount becomes due that day. To redeem the delinquent owner must tender the amount the purchaser paid to buy the Montgomery County Alabama tax lien certificate plus any additional property tax the purchaser has paid up to the expiration of the 3 three year redemption period plus 12 per annum Sec. If it has been tax delinquent for three years or more the state will issue you a tax deed for the property.

The Property Tax Division makes the Book of Lands available for purchase and open for public inspection between 800 AM and. Search Tax Delinquent Properties. Transcripts of Delinquent Property.

State law allows taxes to be paid by persons other than the owners. If you fail to pay your property taxes in Alabama your home could become liened if you owe more than the delinquent amount. To report a criminal tax violation please call 251 344-4737.

John Rogers D-Birmingham calls the interest on delinquent Alabama property taxes totally unfair State Rep. Section 40-10-141 Lien and sale of property for unpaid installments of taxes - Procedure. Once you have found a property for which you want to apply select the CS Number link to generate an online.

Where can I find a list of tax delinquent property. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Alabama legislator seeks to reform Alabama property tax law.

The Alabama Manufactured Home Act 91-694 signed into law July 18 1991 changed the way manufactured homes are treated for tax and revenue purposes in Alabama. January 30 2022632 pm.

Alabama Tax Sales Tax Liens Youtube

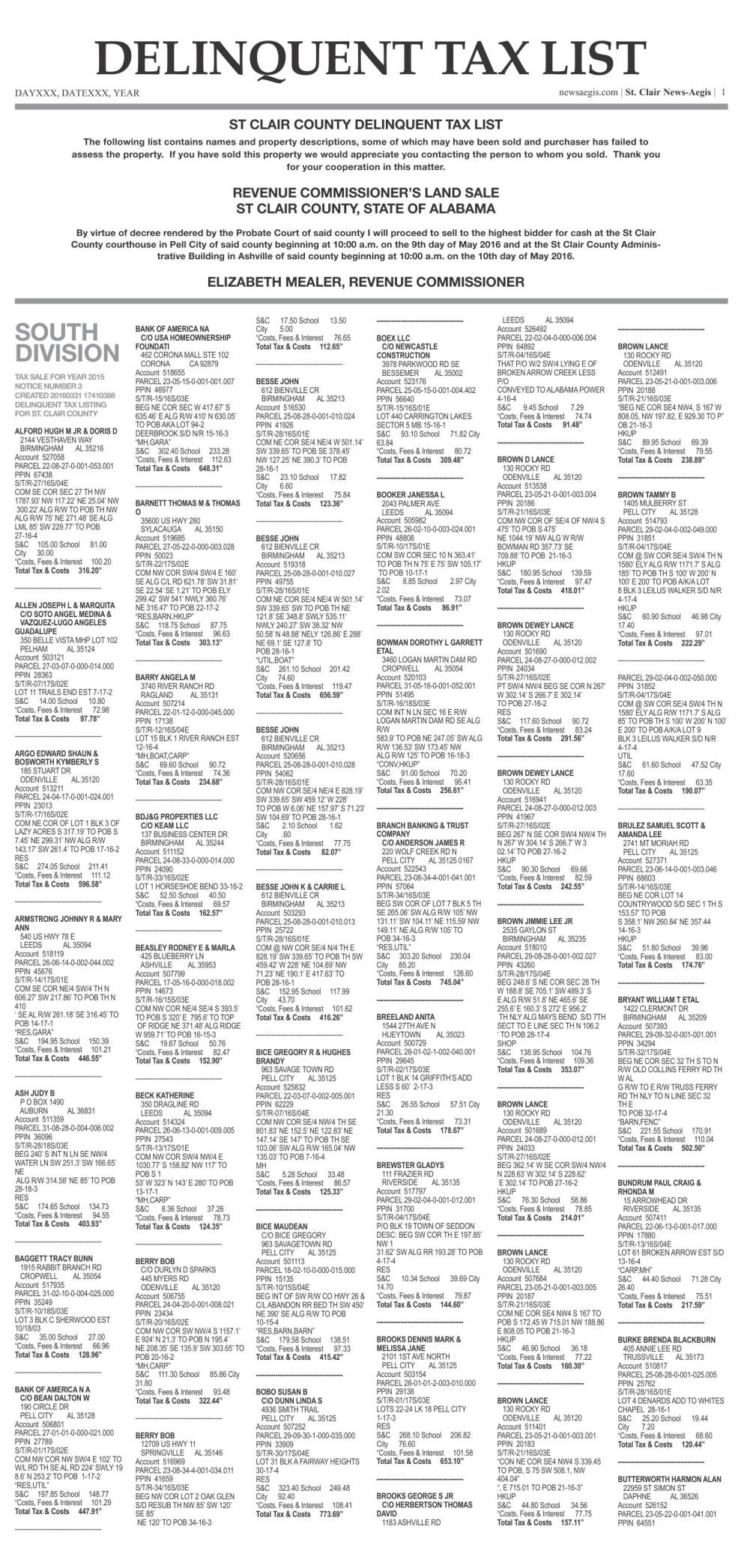

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

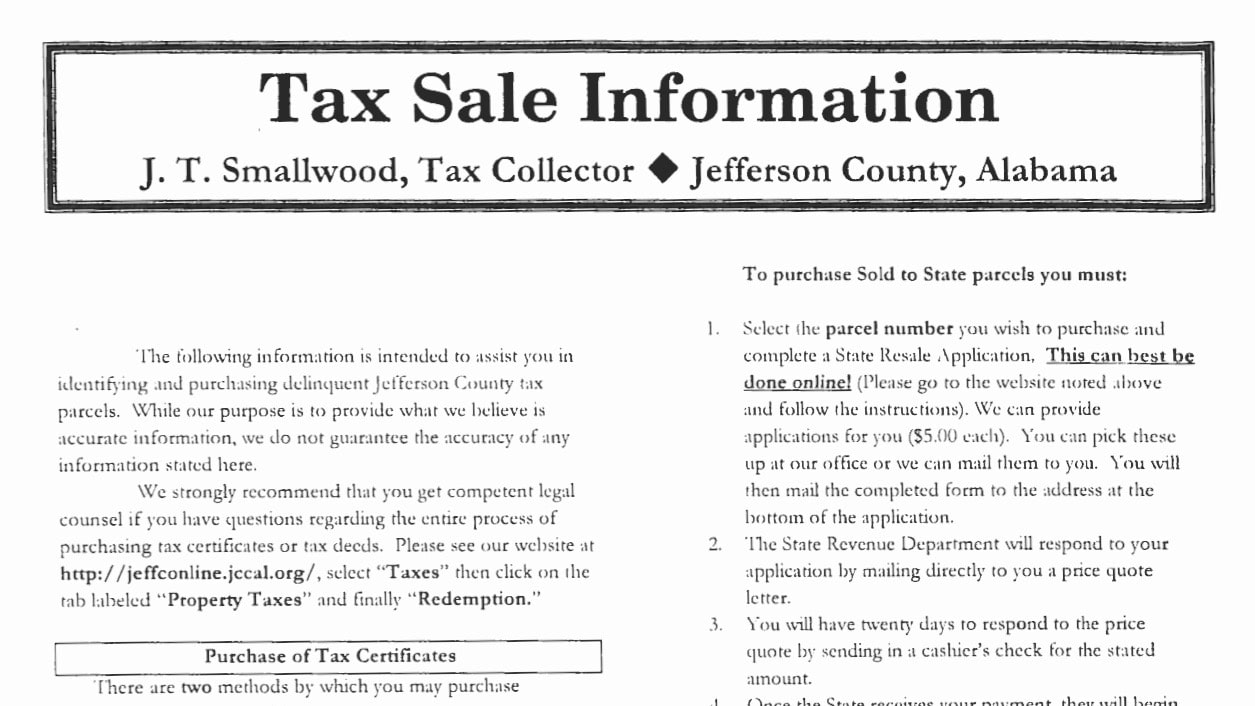

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Does Alabama Auction Your Home For Delinquent Property Taxes Ozark

Opelika Observer Lee County 2019 Delinquent Tax List By Opelikaobserver Issuu

Baldwin County Property Taxes A Comprehensive Guide

Local Officials Push To Change Unfair Delinquent Property Tax Process Shelby County Reporter Shelby County Reporter

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure