san antonio sales tax permit

The December 2020 total local sales tax rate was also 8250. San antonio local sales tax permit thirts.

IRS San Antonio EIN Information 3.

. Complete in just 3 easy steps. Apply Online In 2 Minutes. San Antonio TX 78205.

Complete the application if you are engaged in business in Texas and. 1901 South Alamo Street San Antonio TX 78204. Development Services Department One Stop Center.

San Antonio TX Sales Tax Rate. Skip the Lines Apply Online Today. A San Antonio Texas Sales Tax Permit can only be obtained through an authorized government agency.

Ad Get started apply for your Texas Sales Tax Permit. Ad Get Your Free Sales Tax Bond Quote. Get Licening for my thirts tax id in 78205 San Antonio san antonio local sales tax permitTax ID Registration Requirements for thirts in San Antonio.

Skip the lines apply online today. Texas Comptroller of Public Accounts. San antonio sales tax permit Saturday May 7 2022 Edit.

Fast Easy and Secure Online Filing. A garageyard sale permit may be purchased at City Online Payments or at one of the following locations for a fee of 16. As of 1232021 91118 pm you can obtain your san antonio sellers permit here at 39 plus any tax you may have to pay in advance.

Mailing Address The Citys PO. Complete in Just 3 Steps. The City of San.

Carls Jr Tink-A-Tako and The Mad Marlin last week joined about 175 other businesses that received permits to collect sales taxes in Bexar County. Box is strongly encouraged for all incoming. PersonDepartment 100 W.

Most San Antonio-County businesses are required to get some sort of operating business license or a business permit from the state or from your corresponding county or city. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Get San Antonio thirts License.

Ad Apply For Your Texas Sellers Permit. A sales tax permit can be obtained by registering through the Texas Online Sales Tax Registration Application System or by mailing in the Sales and Use Tax Permit Application. Skip the Lines Apply Online Today.

You also need a business tax registration license and a an assumed business name if you have a retail. Complete in Just 3 Steps. Food Service If you plan to prepare and sell food call the San Antonio Metropolitan Health District.

Ad Get Your Texas Sellers Permit for Only 6995. Where do I get a State of Texas sales tax permit. What is the sales tax rate in San Antonio Texas.

Fast Easy and Secure Online Filing. Depending on the type of business where youre doing business and other specific. Sell or lease tangible personal.

San antonio sales tax permit. City of San Antonio Print Mail Center Attn. How To Get A Sellers Permit In San Antonio Texas PepRetail Trade Retail in San Antonio Bexar County TX.

Fast easy and secure filing. The type of license or permit needed is based on the product or service you plan to provide. A South San Antonio Texas Sales Tax Permit can only be obtained through an authorized government agency.

San antonio local sales tax permit. Retail businesses need at least a resale permit or wholesale license AKA seller permit. 4 rows The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125.

A San Antonio Texas Sales Tax Permit can only be obtained through an authorized government agency. For all building inspections and additional permits contact the Bexar County Fire Marshall at 210 335-0300 or at their offices located at 622 Dolorosa St Suite 420. Ad Apply For Your Texas Sellers Permit.

Depending on the type of business where youre doing business and other. This is the total of state county and city sales tax rates. Information is valid as of.

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Truck Driver Letter Sample. Date Published 2011-06-25 051253Z. Independent sales reps of direct sales organizations direct sales organizations are required to collect sales tax from the independent distributors persons requesting a sales tax permit.

The minimum combined 2022 sales tax rate for San Antonio Texas is. Taxpayer 32079672708 is a taxpayer entity registered with texas comptroller of public accounts. Check san antonios fact sheet for an overview of the hotel occupancy tax.

The current total local sales tax rate in San Antonio TX is 8250.

How To Register For A Sales Tax Permit In Texas Taxvalet

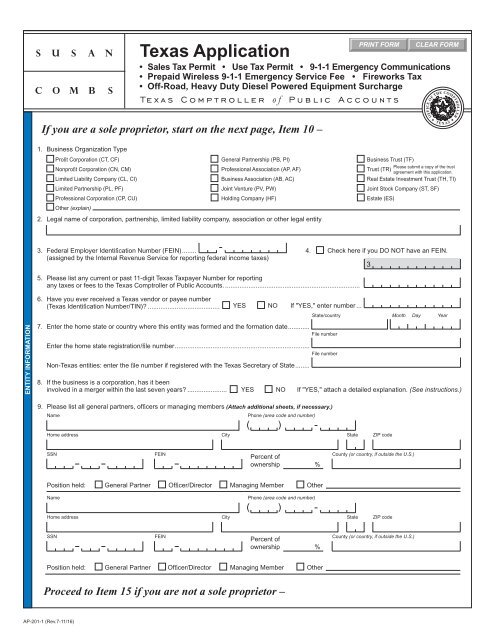

Form Ap 201 Fillable Texas Application For Sales Tax Permit Use Tax Permit And Or Telecommunications Infrastructure Fund Assessment

Form Ap 201 Fillable Texas Application For Sales Tax Permit Use Tax Permit And Or Telecommunications Infrastructure Fund Assessment

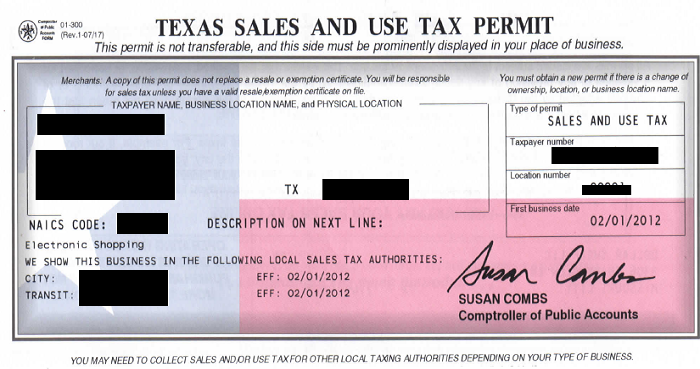

Tax Sales Tax Sales Use Permit Texas

San Antonio Alarm Permit Fill Out And Sign Printable Pdf Template Signnow

What Is A Sales And Use Tax Permit

Faqs Bexar County Tx Civicengage

How Do I Register For A Sales Tax Permit Youtube

Start A Business Bexar County Tx Official Website

Faqs Bexar County Tx Civicengage

Ap 201 Texas Application For Texas Sales And Use Tax Permit

Form Ap 201 Fillable Texas Application For Sales Tax Permit Use Tax Permit And Or Telecommunications Infrastructure Fund Assessment

How To Register For A Sales Tax Permit In Texas Taxvalet

How To Register For A Sales Tax Permit In Texas Taxvalet