cryptocurrency tax calculator canada

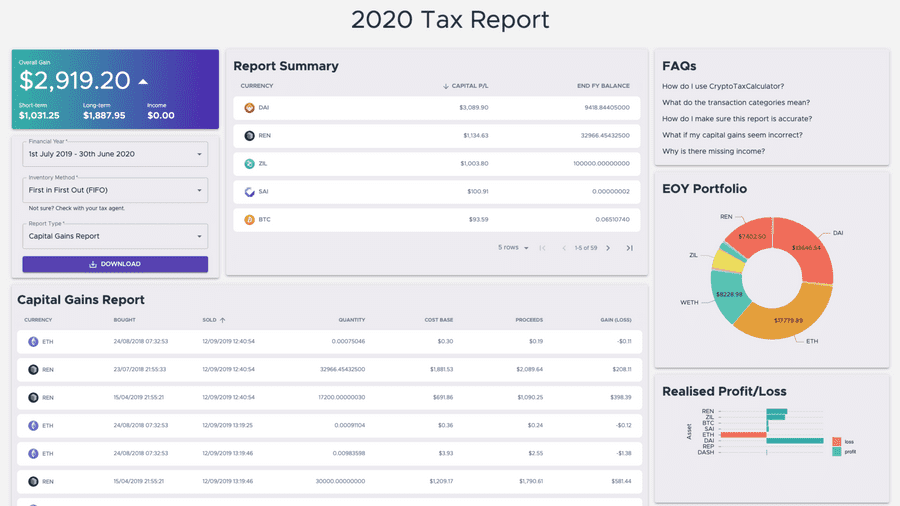

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. For income tax purposes the Canada Revenue Agency treats any income you earn from transactions involving cryptocurrency as business income or capital gains depending on the circumstances.

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Why you need to value your cryptocurrency for your taxes.

. Buy Bitcoin Ethereum Litecoin and more in Canada Buy Sell with 0 funding fees 0 withdrawal fees on Coinberry. Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

Paying taxes on cryptocurrency in Canada doesnt have to be a headache. The Canadian Revenue Agency CRA has published a detailed tax guide for the taxation of cryptocurrencies and digital assets such as bitcoin. Calculate and report your crypto tax for free now.

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. For example if you have made capital gains amounting to 20000 in a certain year.

A simple way to calculate this is to add up all your capital gains and then divide this by 2. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. CoinLedger began in 2018 as CryptoTrader. Yes you do need to pay tax on crypto in Canada.

If your only income is through crypto the basic personal amount allows you to earn 13808 before you need to pay taxes. However it is important to note that only 50 of your capital gains are taxable. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA. The tax return for 2021 needs to be filed by the 30th of April 2022. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

Crypto Taxes for Canadians learn taxpayer responsibility for Bitcoin and cryptocurrency investors how to keep records and calculate gain and loss for tax purposes. The basic personal amount. Form 8949 Schedule D.

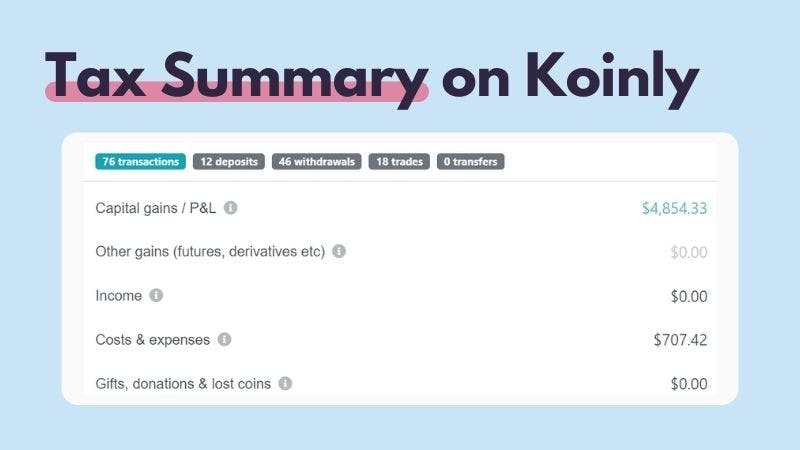

How Koinly Can Help Calculate Canada Crypto Taxes. To work cryptocurrencies rely on a sort of technology known as a blockchain- a form of a highly secure database that records and maintains transactions. If you are filing in the US Koinly can generate filled-in IRS tax forms.

You will need to calculate the value. Tax in response to the challenges of crypto tax reporting. You can discuss tax scenarios with your accountant.

Its a cryptocurrency and NFT tax calculator that helps automate the crypto tax reporting procedure. The CRA says Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. The CRA Canadian Revenue Agency has fairly straightforward rules when it comes to cryptocurrencies.

Since it began CoinLedger has become a trusted name in cryptocurrency. For income tax purposes cryptocurrency is Read more. Cryptocurrency is taxed as capital gains.

The CRA treats cryptocurrencies similarly to commodities such that the tax implications are that individuals in Canada need to calculate and report their capital gains when they sell or trade a virtual currency. Report crypto on your taxes easily using Koinly a crypto tax calculator and software. You can use crypto as an investment as a currency for spending or as a source of passive income.

This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. Whether you are filing yourself using a tax software like TurboTax or working with an accountant. Koinly can generate the right crypto tax reports for you.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. As such you must declare your earnings on your tax return. Canadian individual crypto taxpayers are required to use the average cost accounting method for capital gains tax calculationsMore specifically the CRA states that the ACB is the cost of property and that in the case of identical properties you use the average cost of each property to determine your adjusted cost basis.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Our platform allows you to import transactions from more than 450 exchanges and blockchains today. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

However the Superficial Loss Rule - which applies to crypto transactions can complicate things for prolific investors using tax loss harvesting. Guide for cryptocurrency users and tax professionals. If you are using cryptocurrency to invest you will be taxed on the capital gains when you sell it.

50 of your crypto gains. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. For anyone that only makes income through cryptocurrency investments and trading this effectively ensures you can maintain a basic level of income before being taxed.

Adjusted cost basis accounting. You simply import all your transaction history and export your report. Download your tax documents.

The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

How To Calculate Crypto Taxes Koinly

Capital Gains Tax Calculator Ey Us

Crypto Tax Calculator Overview Youtube

Crypto Com Tax Tool Review 2022 Free Tax Calculator By Crypto Com

What Is Cryptocurrency How To Calculate Cryptocurrency Canadian Tax In 2022 Cryptocurrency Investing In Cryptocurrency Bitcoin

Net Income Tax Calculator Manitoba Canada 2020

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services