capital gains tax proposal canada

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. The income is considered 50 of the capital gain.

/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

The 500 will need to be added as taxable income and youll.

. On August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft. Thus ETFs can realize large amounts of capital gains in connection with such redemptions but under subsection 13253 were left without an effective method of. The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption from.

There are seven federal income tax rates in 2023. How To Avoid The Capital Gains Tax Loans Canada In Canada 50 of the value of any capital gains is taxable. To emphasize how favourable this is consider a situation where you received a 1000 capital gain.

In Canada capital gains are taxed very favourably with only 50 of a capital gain being taxable. A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold.

As of 2022 it stands at 50. If you bought a cottage for 200000 and now sell it for 500000 you will receive. Capital Gains in Canada.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. The total amount you received when you sold the shares was 5000. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Person clients living in Canada who sell assets Mr. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. This would replace capital gains tax with business income tax for properties.

Since its a capital gain only 500 of the 1000 is subject to tax at your marginal rate. Candidates and their political parties are proposing several changes to the current tax schemes. Since its more than your ACB you have a capital gain.

Capital gains tax rates are dependent on the. Your sale price 3950- your ACB 13002650. However you would be allowed to claim CCA expense of the undepreciated building cost 4 subject to income limitations to offset a portion of rental income each year until Year 5.

In Canada 50 of the value of any capital gains is taxable. The inclusion rate is the percentage of your gains that are subject to tax. In the 2022 budget announcement the federal government proposed an anti-flipping tax.

The sale price minus your ACB is the capital gain that youll need to pay tax on. For example if you sold an asset for 2000 that has an ACB of 1000 the taxable income is 500. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. The 50 percent inclusion rate remained in place until the late 1980s. The most common capital gains are realized from the sale of stocks bonds.

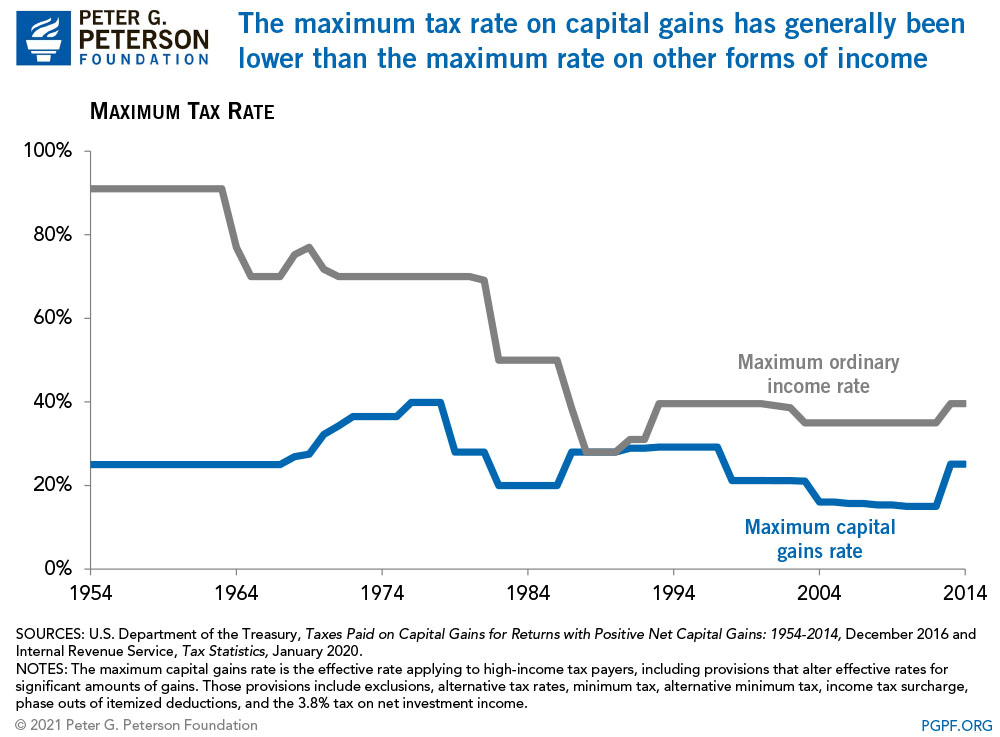

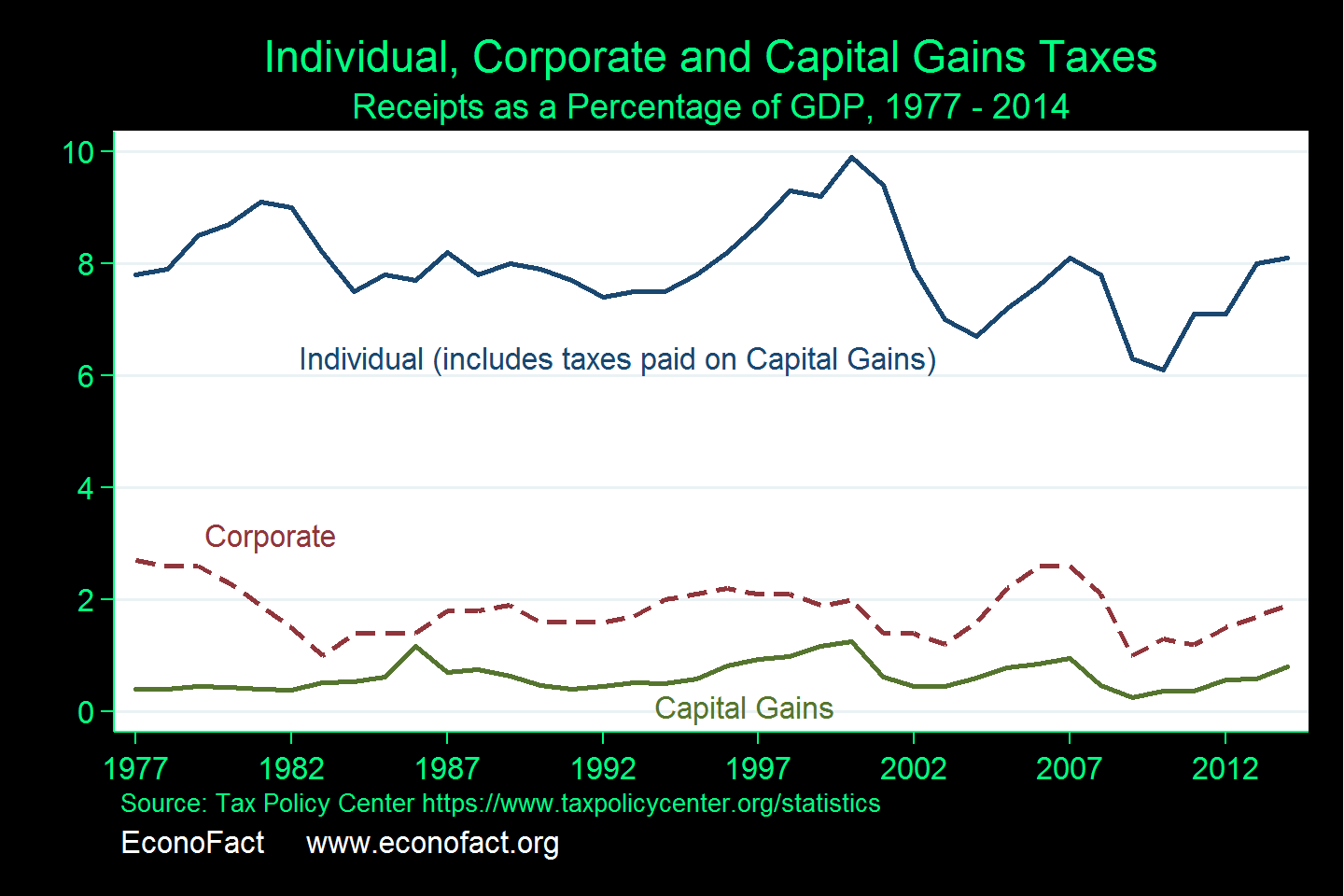

If you sell an investment at a higher price than you paid youll have to add 50 of the capital gains to your income. When you buy a home you must pay tax on its fair market value at the time of purchase. The inclusion rate has varied over time see graph below.

The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623. 1000 gain x 50.

The New Democratic Party NDP in particular pledges to increase the capital. Your new cost basis as of Year 5 would be 850000.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

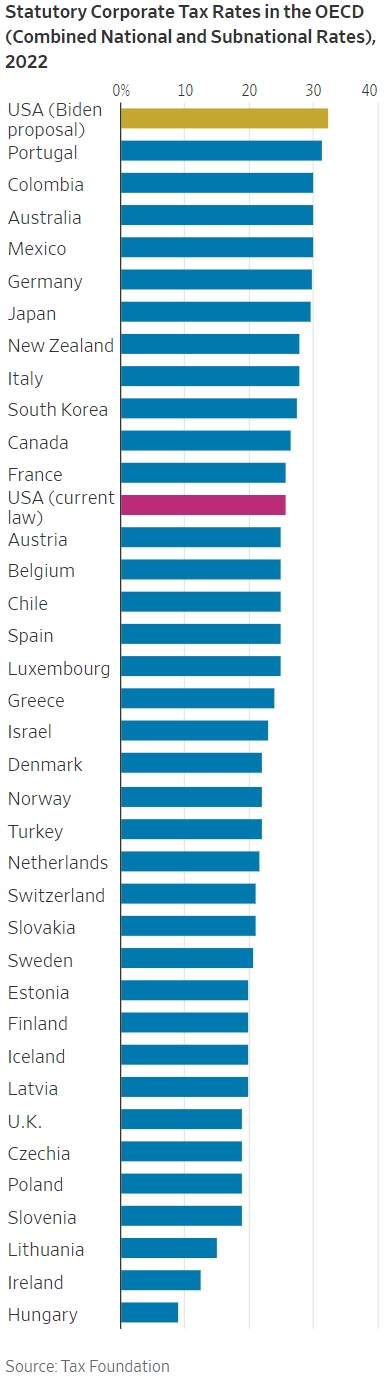

Biden S Anti Competitiveness Tax Grab International Liberty

Be Careful Before Urging Changes To Capital Gains Tax The Globe And Mail

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

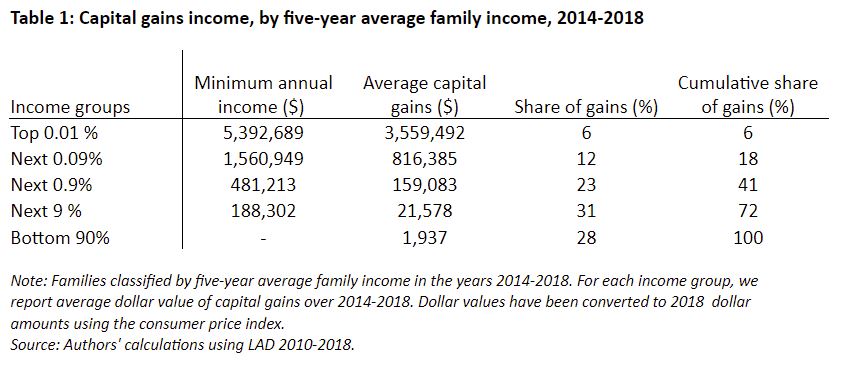

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

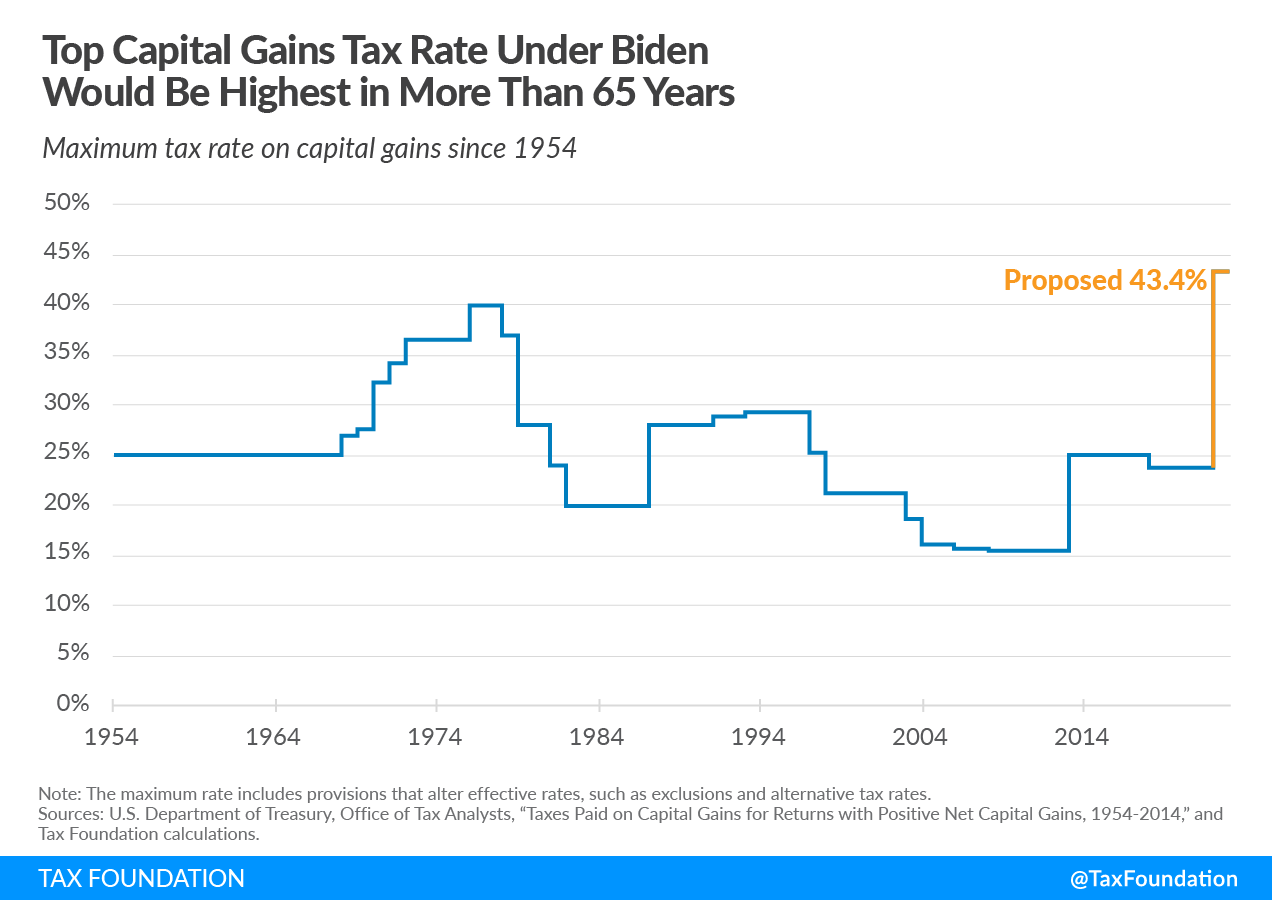

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Sdr Blog The Biden Tax Proposal What You Need To Know

Highlights Of Canada S Latest Legislative Tax Proposals Davies Ward Phillips Vineberg Llp Jdsupra

Capital Gains Tax In The United States Wikipedia

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

The Capital Gains Tax And Inflation Econofact

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

What Are Capital Gains Taxes And How Could They Be Reformed

The Liberal Party S Housing Policy Does Not Include A Capital Gains Tax On Primary Home Sales Fact Check